Income Tax Calculator India

Income Tax Calculator India介绍

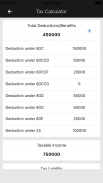

Every Individual should plan Income Tax. Timely and accurate tax is responsibility of every body. Our app "Income Tax Calculator" provide an easy and effective way to calculate your tax liability based on your income and deductions / investments you have done.

There are certain deductions which can be claimed to save tax at the time of Income Tax Filling. If you have done proper Tax Planning to save Tax and made investments where your Tax Liability will get reduced, you can save Tax on Income. You can claim deductions for amount invested in schemes like Insurance, PPF, PF, ELSS, ULIP, NPS, Medical Insurance. Also, you can claim deductions for amounts spent on Education Loan Interest, House Rent, Interest & Principal Paid on Home Loan, Donation made etc.

Our calculator will help you to know the amount of Tax Liability and deductions allowed to different categories of Individuals like Salaried, Self Employed which includes Senior Citizens also. It allows you to make the best use of the various tax exemptions, deductions and benefits available to minimize your tax liability. With the help of this calculator you can plan the Investments under which you can reduce your Taxable Income and thus help you to save Tax on your Income.

Keywords: Income Tax Calculator, Income Tax India, Income Tax 2016-17, Income Tax Planning

每一个人都应该计划所得税。及时,准确的纳税是每一个机构的责任。我们的应用程序“所得税计算器”提供了一种简单而有效的方式根据您的收入和你所做的扣减/投资来计算你的税务负担。

有可以声称在所得税填充时节省一定的税收扣除。如果你做了适当的税务筹划,以节省税务和所作的投资在您的税务负担将得到减轻,可以在所得税节税。您可以要求赔偿投资方式,如保险,PPF,PF,ELSS,ULIP,NPS,医疗保险金额扣除。此外,您还可以要求对用于教育贷款利息,房租,利息和本金支付的住房贷款金额扣除,捐赠等制成

我们的计算器将帮助您了解税务责任及扣除允许不同的类别,如工薪,自雇其中包括长者个人还的数额。它可以让你提供给你降到最低应纳税额的各种税收减免,扣除和效益的最佳利用。有了这个计算器的帮助,你可以计划下,你可以减少你的应纳税所得额,从而帮助您节省您的所得税的投资。

关键词:所得税计算器,所得税印度,所得税2016-17,所得税规划